Table of Contents

The European Union is launching an investigation into the aluminium market following Donald Trump’s new tariffs.

EU Announces Aluminium Trade Investigation

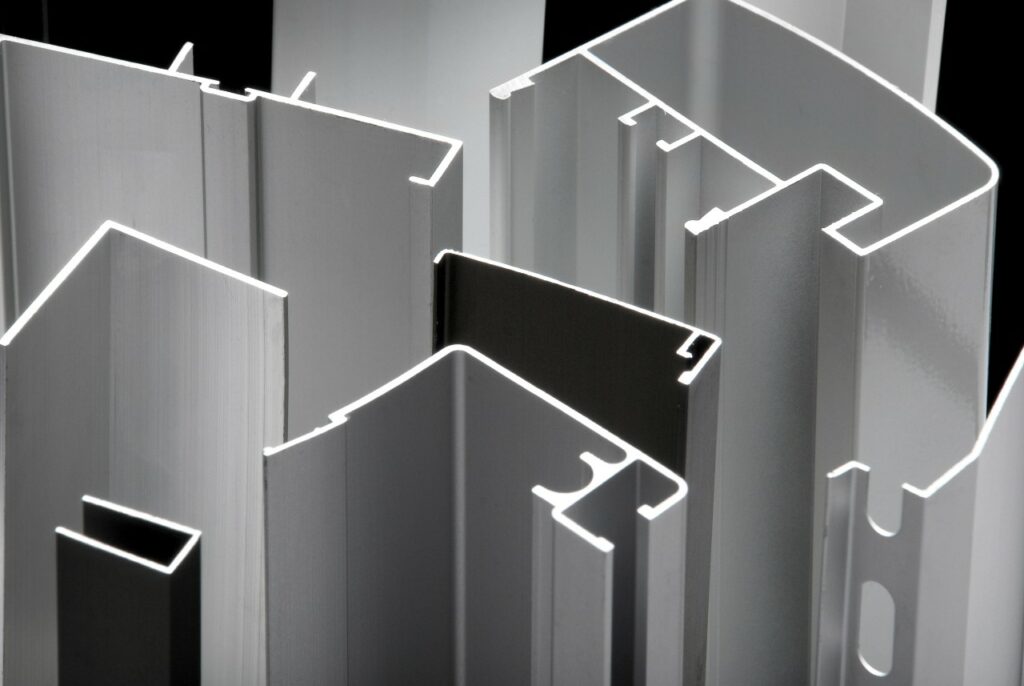

The European Commission is set to announce a formal investigation into the aluminium market, examining a sudden rise in imports. According to an internal document seen by the Financial Times, the probe will focus on verifying the extent of trade diversion caused by the US tariffs and will target all major aluminium-exporting countries. In addition, the EU will take steps to tighten existing loopholes in its steel tariff policies.

Trump’s Tariffs and EU Retaliation

Last week, former US President Donald Trump imposed a 25% tariff on all steel and aluminium imports, a move that has significantly reshaped global trade flows. In response, the European Union has vowed to retaliate with tariffs on up to €26 billion worth of US goods. The EU sees these unilateral US measures as a disruption to fair trade and aims to counterbalance the economic impact on European manufacturers.

Impact on the EU Aluminium Industry

The EU’s aluminium sector has been struggling over the past decade, losing substantial market share. Production has not fully recovered since the Covid-19 pandemic, and the situation has been worsened by high energy costs, sluggish demand, and an influx of cheap aluminium imports, particularly from Russia and other global suppliers.

“The recently announced US tariffs on aluminium are likely to worsen the situation further with a significant threat of trade diversion from multiple destinations,” the Commission’s document stated. With suppliers seeking alternative markets due to the US restrictions, the EU fears it may become a dumping ground for excess aluminium from other parts of the world.

Exemption and Major Aluminium Exporters

While the US tariffs impact all steel and aluminium imports, the EU is considering possible exemptions. Countries such as Norway and Iceland, which are part of the EU’s economic area, may be excluded from any trade restrictions. However, key aluminium suppliers like the United Arab Emirates, Russia, and India remain under scrutiny.

Russian aluminium imports have been declining since the country’s full-scale invasion of Ukraine in 2022, dropping to just 6% of total EU imports last year. The EU has already decided to phase out Russian aluminium completely by 2026 and has expanded tariffs that previously applied only to a fraction of these imports.

Future Actions: Strengthening Trade Defenses

The EU plans to introduce several measures to prevent trade circumvention and protect its industries.

- New Tariff System: The EU may adopt a system similar to its 2018 steel safeguards, setting import quotas and imposing a 25% tariff on any excess metal imports.

- Tighter Regulations on Chinese Imports: There are growing concerns that China may use third-party countries to bypass EU tariffs. To counter this, the Commission will introduce a “melted and poured” rule, preventing metal produced in a tariffed country but processed elsewhere from avoiding duties.

- Reciprocal Export Bans: The EU is considering retaliatory measures against countries that restrict exports of scrap metal to the bloc. Scrap steel exports have more than doubled in recent years, accounting for 20% of production, depriving EU steelmakers of a key raw material.

- Carbon Border Tax Protection: With the Carbon Border Adjustment Mechanism (CBAM) set to take effect next year, the EU will introduce new levies on carbon-intensive imports, including steel and aluminium, to level the playing field for European producers.

- Investment in Green Industry: The Commission is encouraging governments to cut energy taxes for heavy industries and increase subsidies for hydrogen technology to reduce emissions. The EU steel industry estimates it will need €14 billion annually until 2030 to transition to greener production methods.

Conclusion

As the US tariffs disrupt global trade, the EU is taking proactive steps to shield its aluminium and steel industries from excessive import surges. With a mix of new trade restrictions, tariff adjustments, and sustainability incentives, the EU aims to secure long-term stability while pushing back against unfair trade practices. The coming months will be crucial as the European Commission finalizes its response to these shifting global trade dynamics.